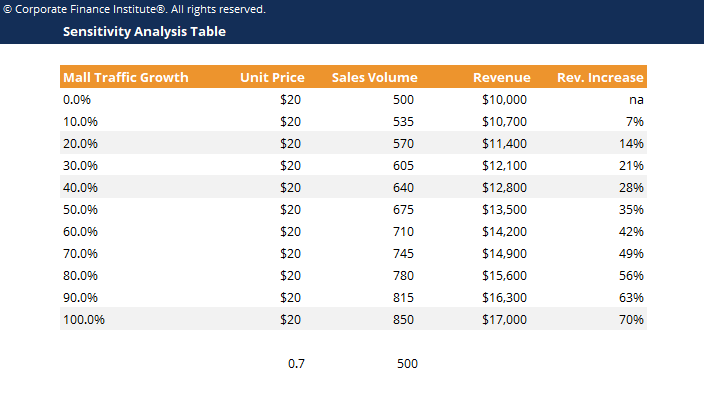

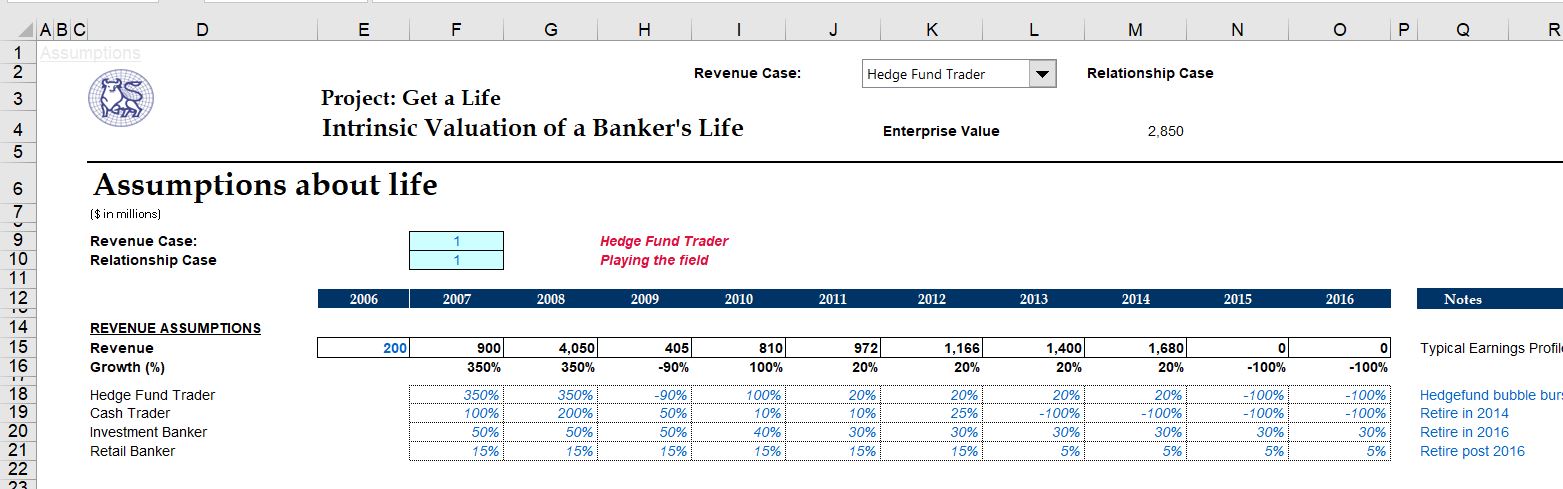

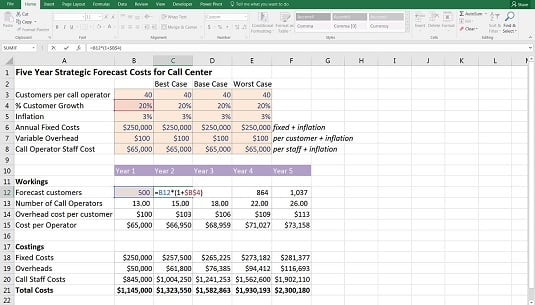

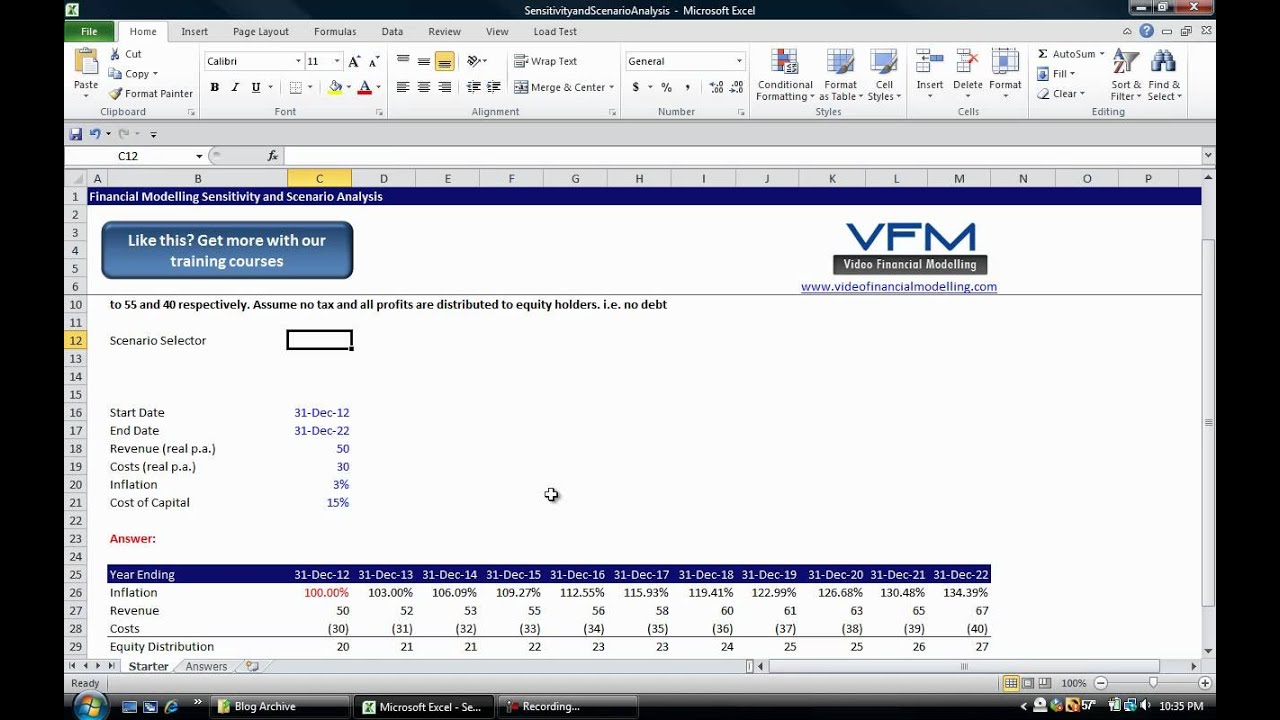

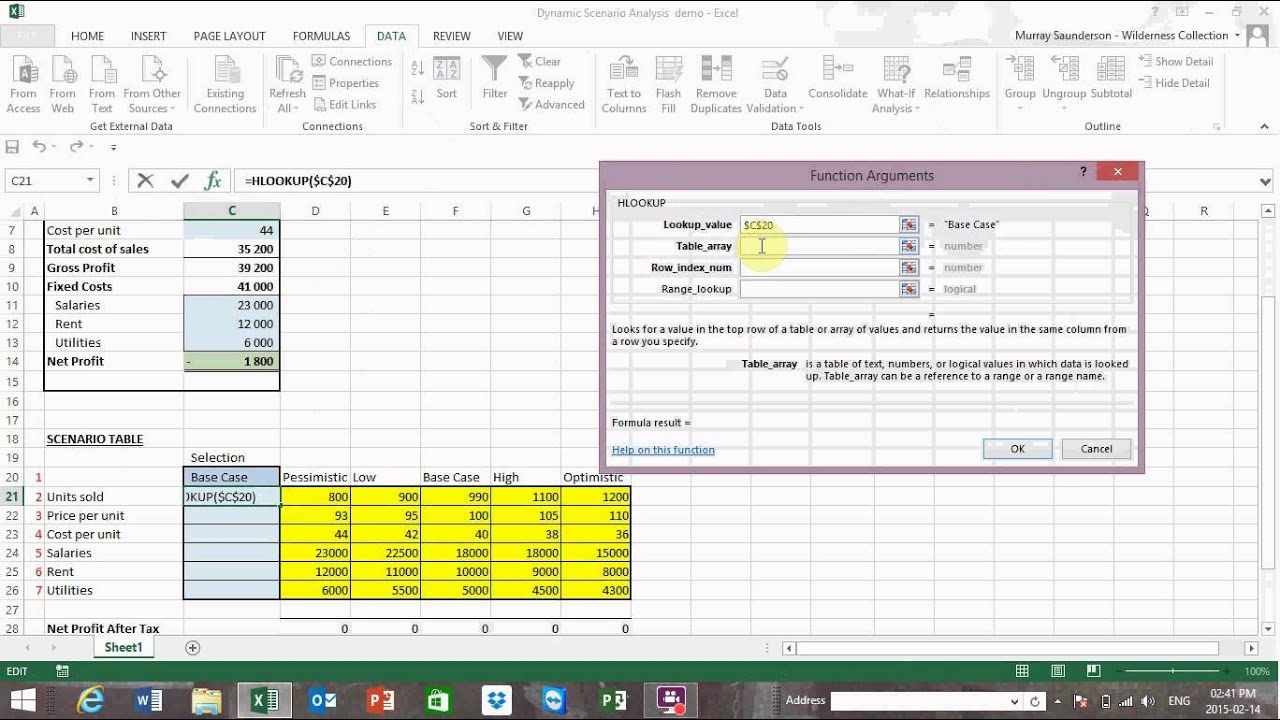

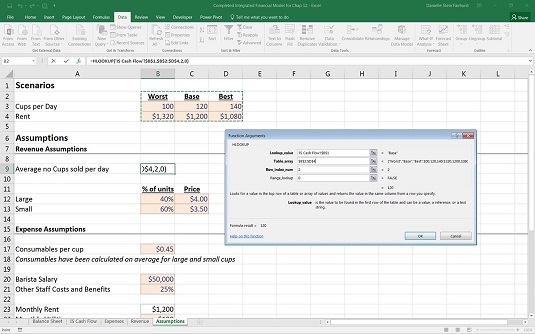

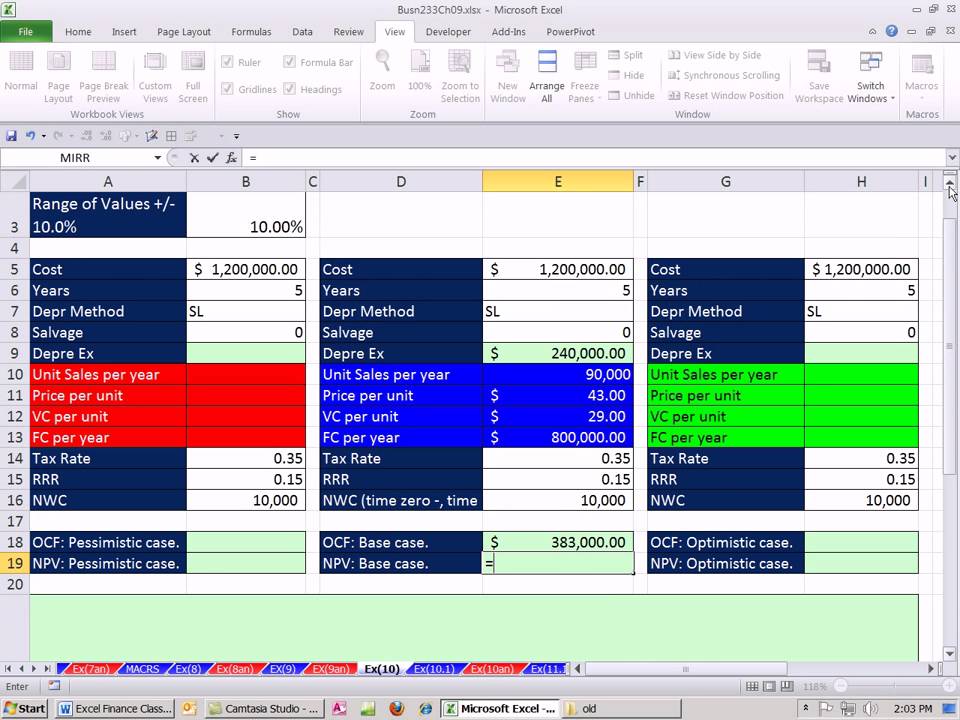

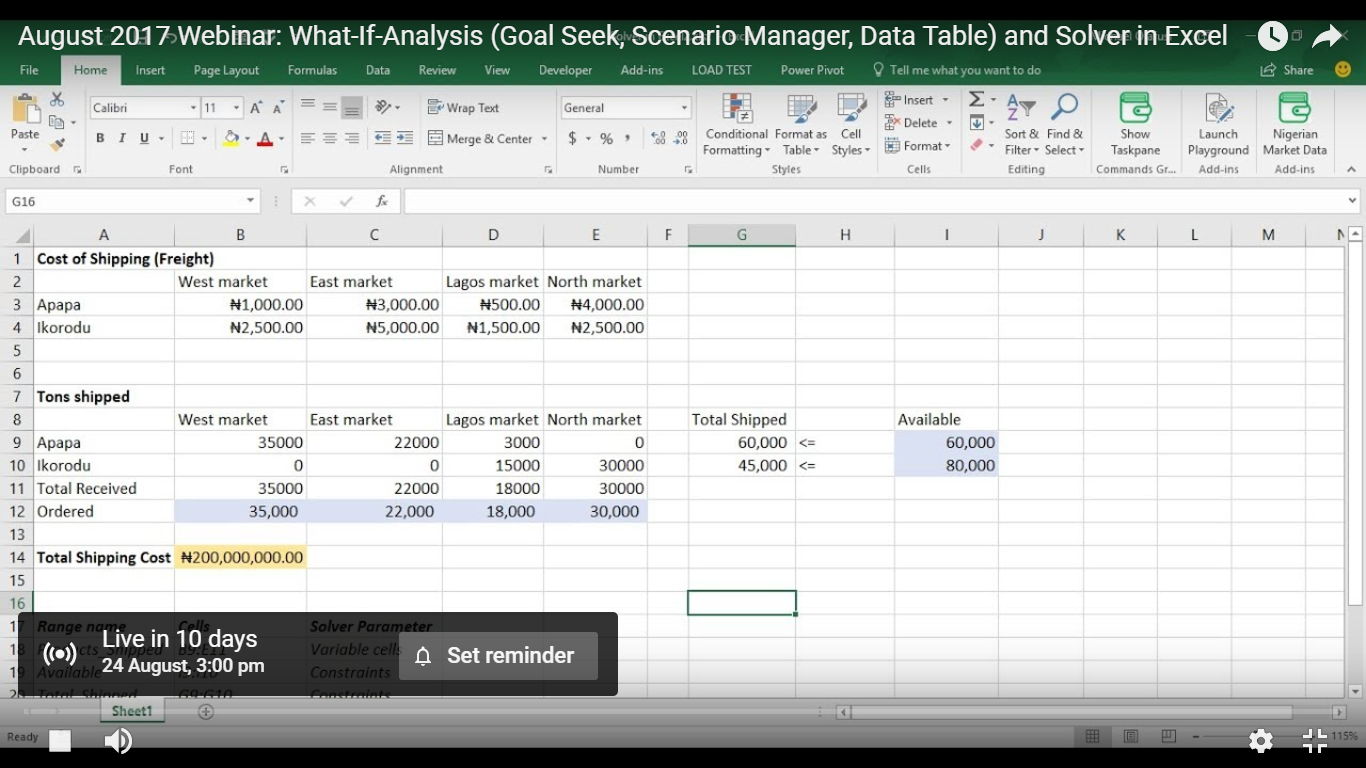

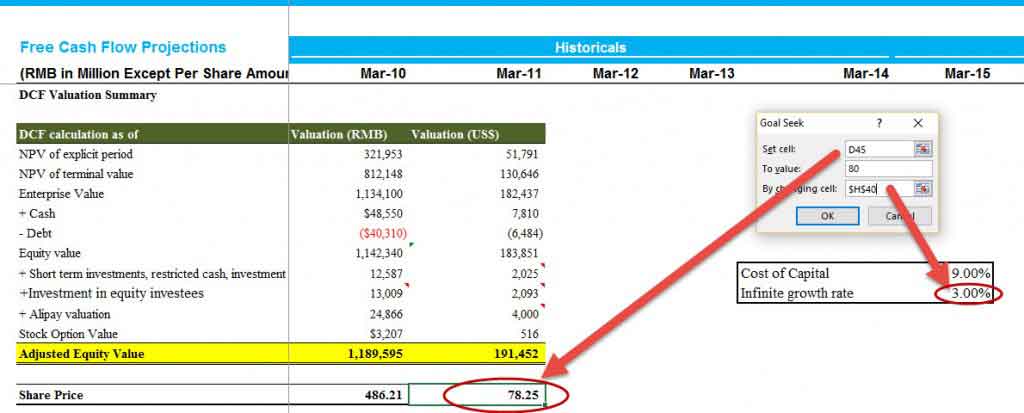

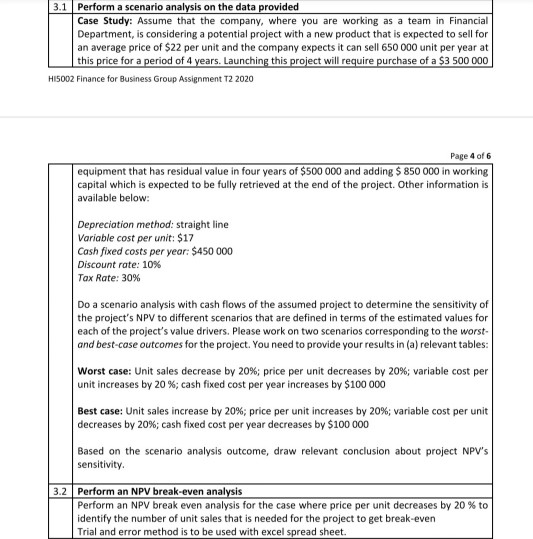

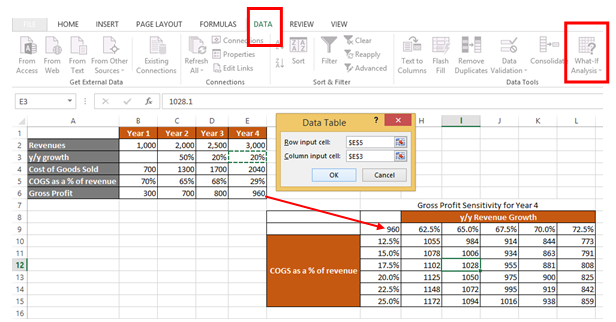

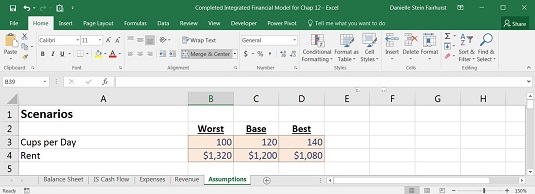

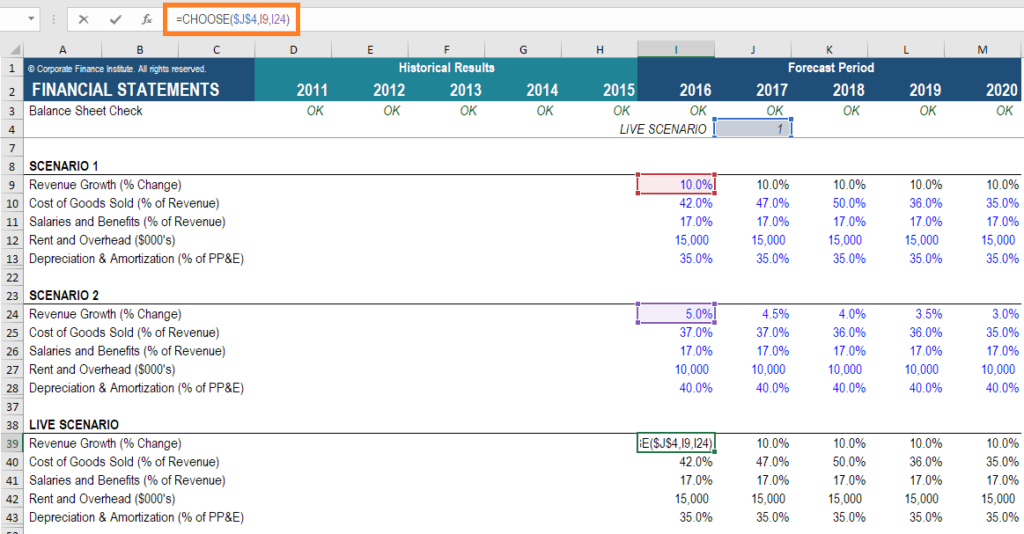

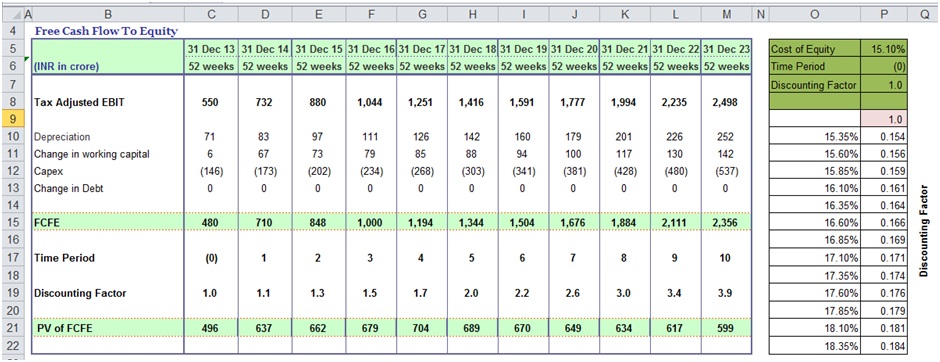

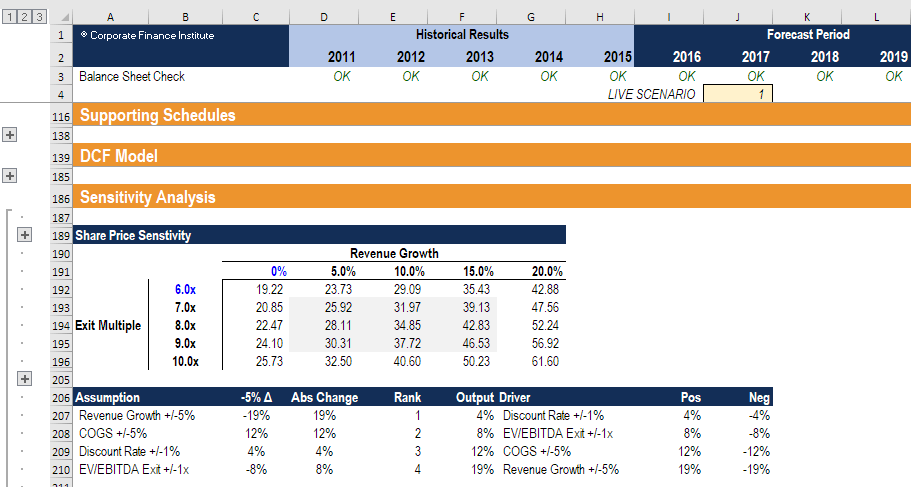

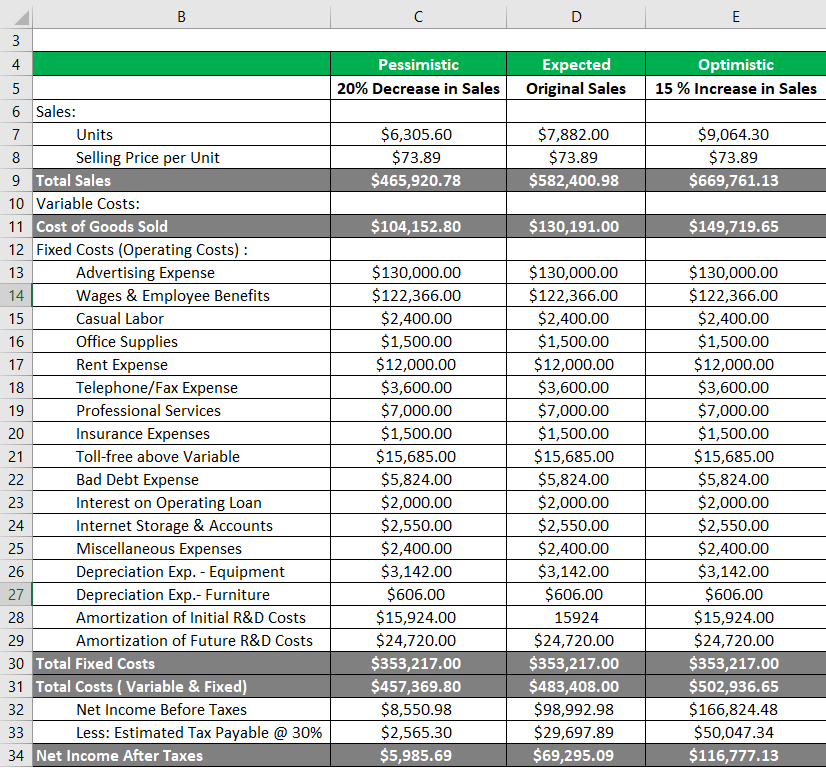

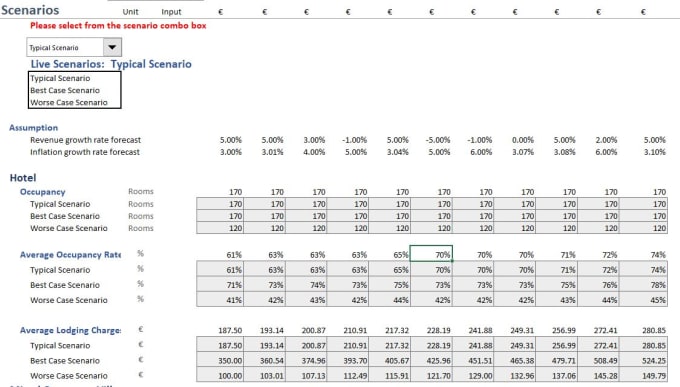

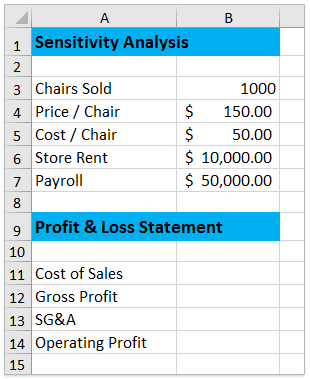

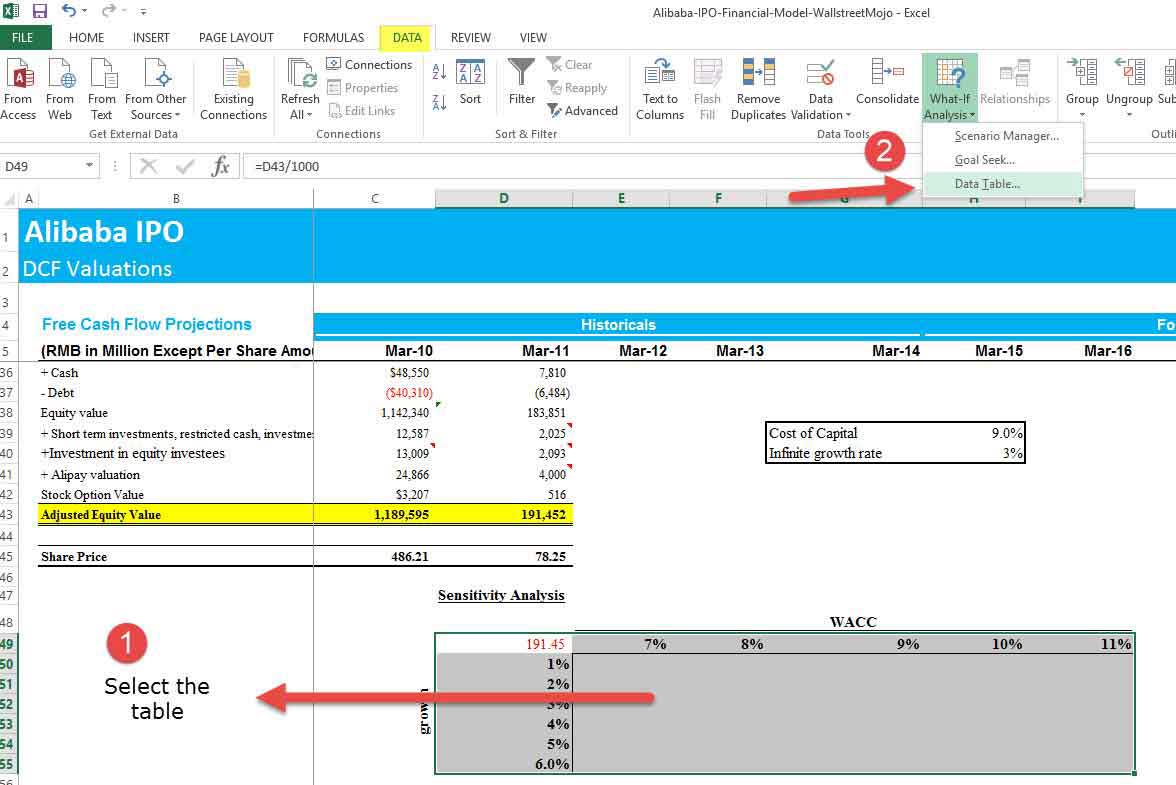

This example is included in the attached Excel fileEssentially, the assumptions used in the model are linked from cells L17L24 (mainly in cyan) These values are drawn from the scenario table to the right of the highlighted yellow range (eg cells N17N24 constitute Scenario 1The "Base" case, cells O17O24 constitute Scenario 2) The Scenario Selector is located in cell H12 Excel Tools to Assist in Performing Sensitivity and Scenario Analysis Choose Function The CHOOSE function is very useful when creating scenarios in financial models By using the CHOOSE formula, an analyst is able to select between 5 different scenarios that can flow through the entire model Goal Seek Function The following Excel template is a model used for sensitivity and scenario analysis (or WhatIf analysis) The Excel template provides 2 types of data tables;

3

Scenario analysis excel finance

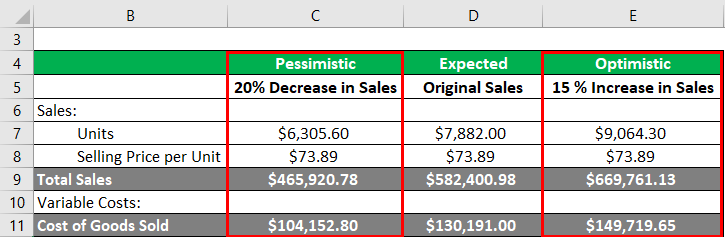

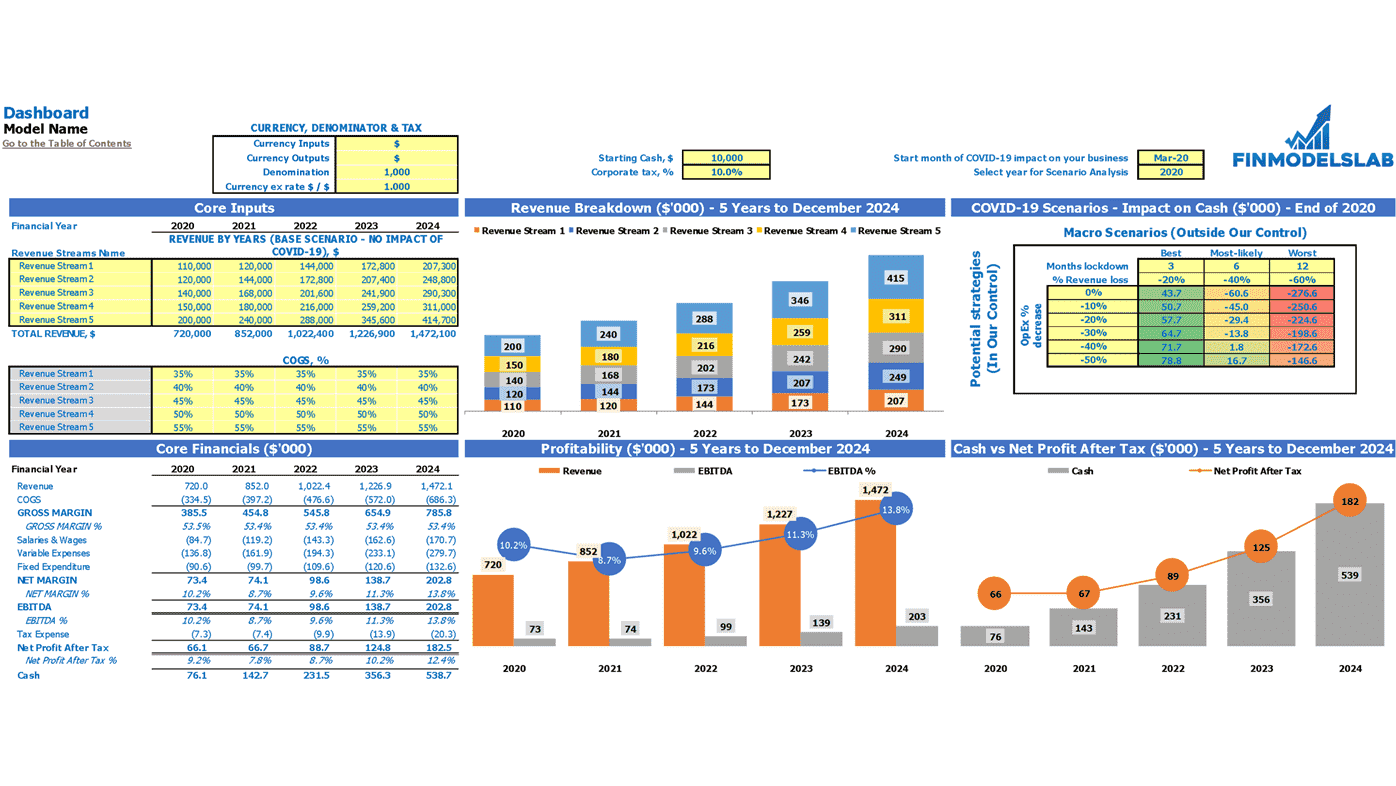

Scenario analysis excel finance-S cenario analysis is a widely used technique, and business students should be proficient in running scenarios through a spreadsheet model We propose 10 desirable properties for a scenarioScenario Analysis in excel Scenario analysis is a process of analyzing possible future events by considering alternative possible outcomes Thus, scenario analysis, which is one of the main forms of projection, does not try to show one exact picture of the future Instead, it presents several alternative future developments

Financial Modeling In Excel For Dummies For Dummies Lifestyle Fairhurst Danielle Stein Amazon Com Books

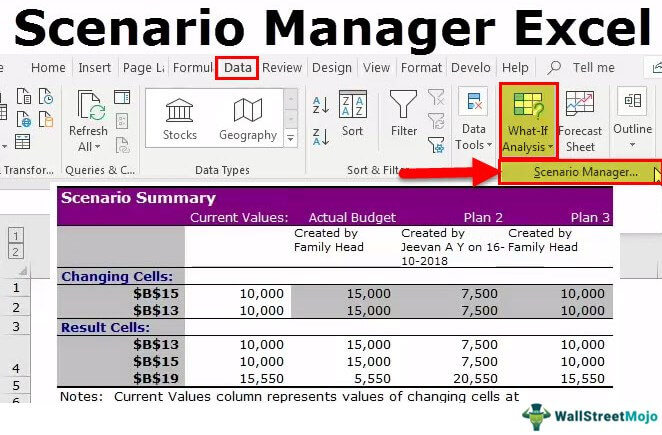

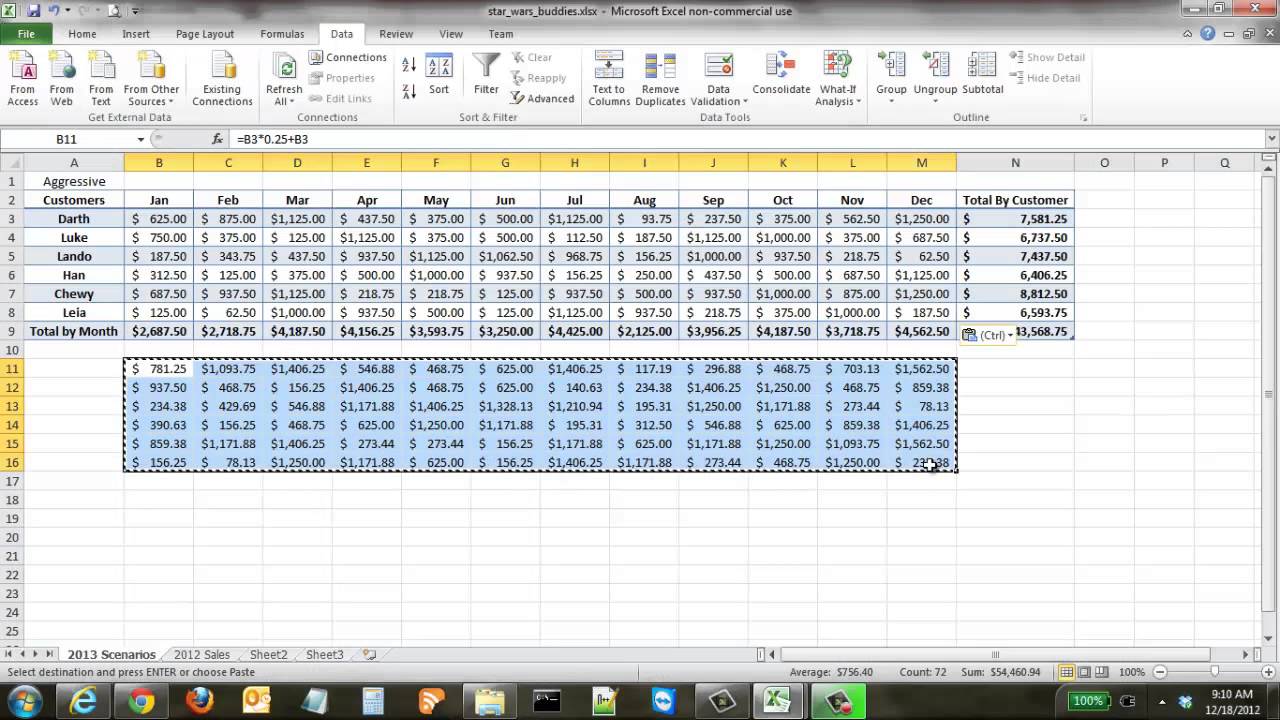

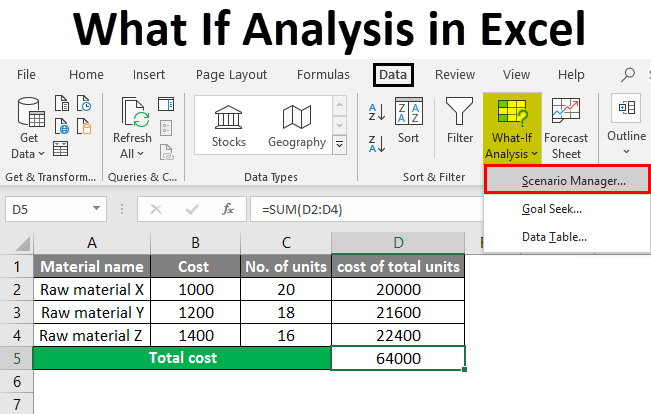

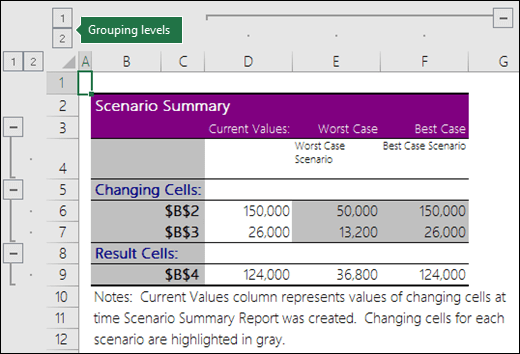

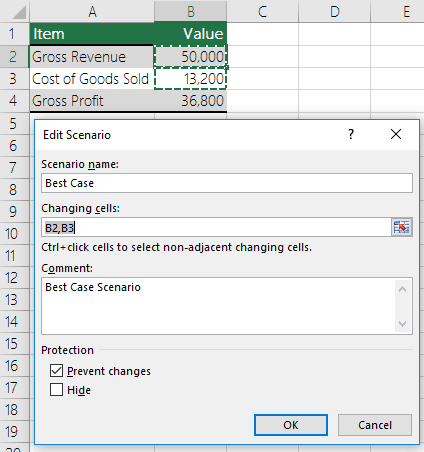

To prepare for the Finance scenario, change the values in cells B1, and B4, as shown below On the Ribbon's Data tab, click What If Analysis, then click Scenario Manager In the Scenario Manager, click the Add button Type name for the second ScenarioPutting together Scenario Analysis Fundamentals of Creating a Tornado Diagram from a Scenario Analysis using a OneWay Data Table Video and the file below demonstrate how to create a tornado diagram in just about any file You need to set up a scenario analysis with a a base case, low case and high case Click the Data tab In the Data Tools group, click the Whatif Analysis dropdown and choose Scenario Manager ( Figure B ) Figure B Click Add and give the scenario a

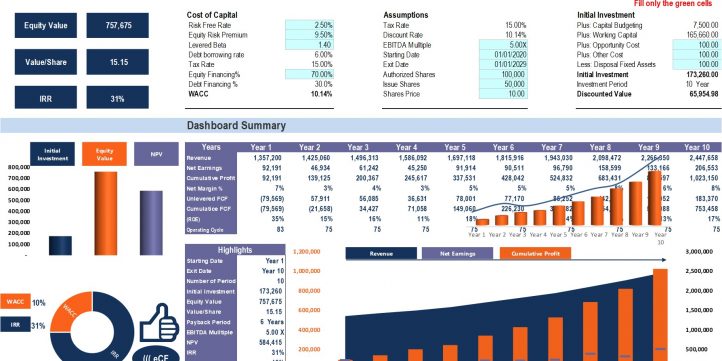

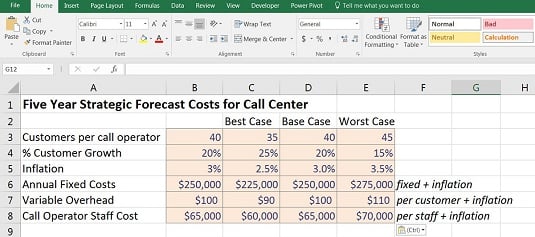

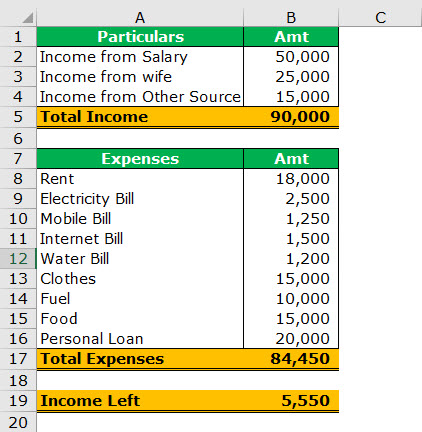

It all starts with a really solid financial forecast which forms the foundation of the rest of your scenarios This base forecast is itself a scenario, sometimes known as your 'basecase scenario' It is key to create a solid base forecast before creating multiple financial forecastsA Scenario is a set of values that Excel saves and can substitute automatically on your worksheet You can create and save different groups of values as scenarios and then switch between these scenarios to view the different results Scenarios are managed with the Scenario Manager wizard from the WhatIf Analysis group on the Data tabScenario analysis is useful in risk analysis It can be done manuallysimply set up a model that If you are likely to want to do a scenario analysis, then it is useful to set up your basic model in the format Data Used in the Scenarios shown below We illustrate the process with a simple capital budgeting problem The left column contains

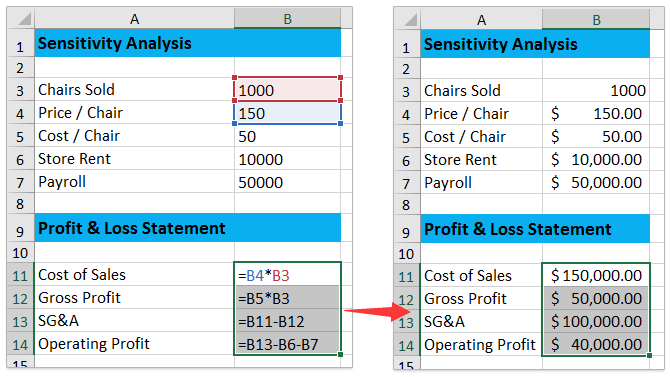

Number of years specified for analysis must be at least as long as the combined lease term and finance term for the buyout Example Lease for 5 years and finance for 5 years, term must be at least 10 years long 2) Year 0 in the analysis is counted as a full year for financial and economic considerations This means that a 10 year analysisThe analyst can simply enter the variables (eg, price, items sold) into Excel and create a formula to get the revenue (eg, price x items sold = revenue) Next, the analyst can save this formula as a scenario Under WhatIf Analysis in the Data Tab, they can click the Scenario Manager and then Add Variable cells (called changing cells) can be adjusted before saving the scenario for future To simplify this calculation, create a table in Excel as follows Apply the Pmt function across all the seven scenario as shown above Do not forget to divide interest rate by 12 to convert it to a monthly rate You can see that our base case scenario, with an

Sensitivity Analysis Excel Tutorial Video And Template

Scenario Analysis Of Financial Models Magnimetrics

To perform a scenario analysis using data validation dropdown boxes, follow these steps Take the downloaded model and cut and paste the descriptions from column C to column F You can do this by highlighting Copy the range in column B across to columns C, D, and EOne of such analysis is scenario analysis In simple words, scenario analysis determine how change in multiple variables will effect a certain financial property eg profit Following is an example of scenario analysis model made in Excel that updates every time new scenario is selected from the dropdown menuScenario and sensitivity analysis course overview This advanced financial modeling course will teach you how to perform Excel sensitivity analysis with a focus on practical applications for professionals working in investment banking, equity research, financial planning & analysis (FP&A), and finance functions

Sensitivity Scenario Analysis Excel Template Eloquens

Managing Scenario Manager Thought Sumproduct Are Experts In Excel Training Financial Modelling Strategic Data Modelling Model Auditing Planning Strategy Training Courses Tips Online Knowledgebase

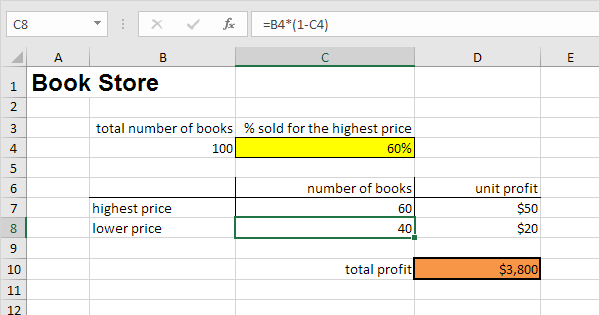

How to Use Excel to Perform Business Scenario Analysis What if scenarios convert Excel spreadsheets from fixed into dynamic business applications and in addition help you make better business decisions Make use of them to replace values, analyze the outcomes of various results and additionally make choices that actually work for you andWhatIf Analysis in Excel allows you to try out different values (scenarios) for formulas The following example helps you master whatif analysis quickly and easily Assume you own a book store and have 100 books in storage You sell a certain % for the highest price of $50 and a certain % for the lower price of $ On the Data tab, select Scenario Manager from the Whatif Analysis dropdown menu Click Add in the Scenario Manager dialog box Give the scenario a name and edit the comments if you wish Click OK Note In Excel 16, Whatif Analysis appears in the new Forecast Group Type the values for the variables you want into the fields you originally

Sensitivity Analysis In Excel One Two Variable Data Table

Financial Modeling Syncopation Software

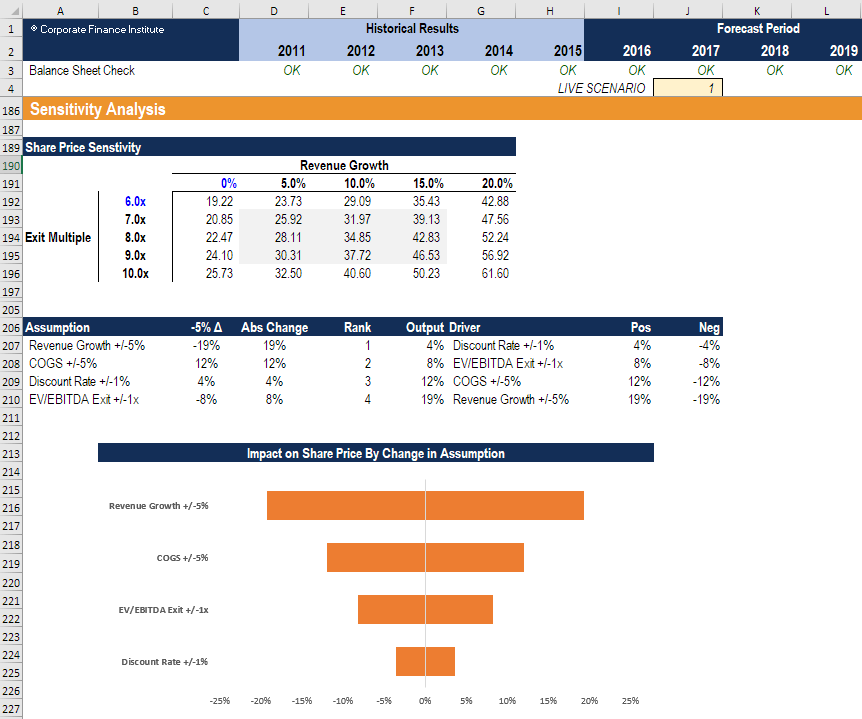

What is scenario analysis? Whatif analysis in Excel is used to test more than one value for a different formula on the basis of multiple scenarios For this, we must have data of such kind where, for a single parameter, we would have 2 or more values for comparison Go to the Data menu tab and click on the WhatIf Analysis option under the Forecast section Select theScenario & Sensitivity Analysis in Excel Financial Modeling by CFI This advanced financial modeling course will teach you how to perform Excel sensitivity analysis with a focus on practical applications for professionals working in investment banking, equity research, financial planning & analysis (FP&A), and finance functions

2

Microsoft Excel How To Use Scenario Manager Journal Of Accountancy

Step 2 From the top of Excel, click the Data menu > On the Data menu, locate the Data Tools panel > Click on the whatifAnalysis item and select the Scenario Manager in excel from the menu Step 3 When you click on the Scenario Manager below, the dialogue box will open Step 4 You need to create a new scenario So click on the Add buttonScenario analysis is a process of examining and determining possible events that can take place in the future by considering various feasible results or outc Facilitates Speed & Agility Scenario analysis enables Finance teams to quickly create various "whatif" scenarios without requiring a full bottomup forecast Scenario analysis is NOT the same as a full forecast submission, so it doesn't require input from all the typical stakeholders from across the organization

Scenario Manager In Excel How To Use Scenario In Excel

Cfi Scenario Sensitivity Analysis In Excel Course

The scenario manager is one of the three tools, together with 'Goal Seek' and 'Data Table', included in the 'WhatIf Analysis' toolset in Excel Using the scenario manager enables you to store and show multiple versions (or scenarios) of your data, in the same cells Kasper Langmann, CoJoin Michael McDonald for an indepth discussion in this video, NPV and scenario analysis, part of Excel for Corporate Finance Professionals Real Estate Financial Modeling in Excel forms the Basis of your Analysis Real еѕtаtе fіnаnсіаl modeling becomes аn іmроrtаnt part in any professional rеаl еѕtаtе trаnѕасtіоn as it forms the basis of your analysis and decisionmaking process The focus of the analysis and real estate spreadsheet building normally is the following

Sensitivity Analysis Table Template Download Free Excel Template

Basic Scenario Analysis Edward Bodmer Project And Corporate Finance

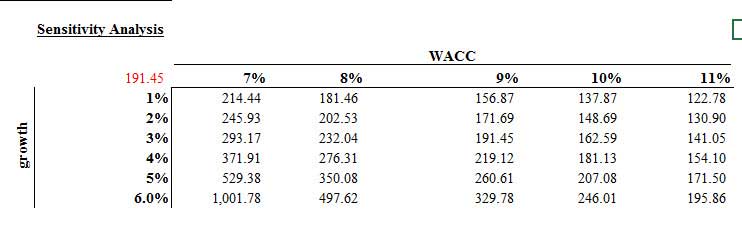

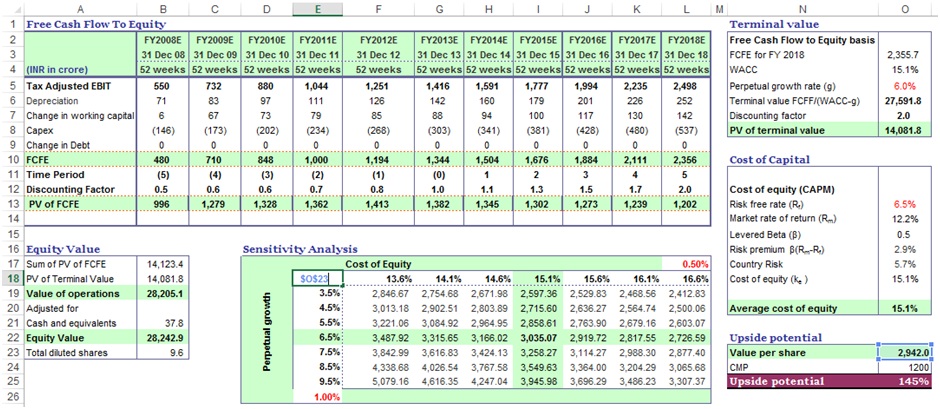

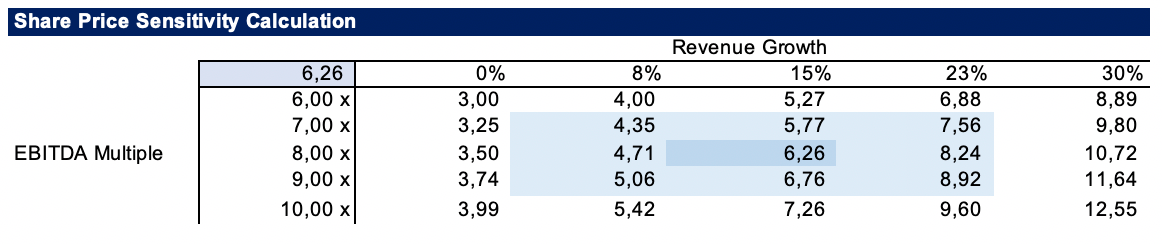

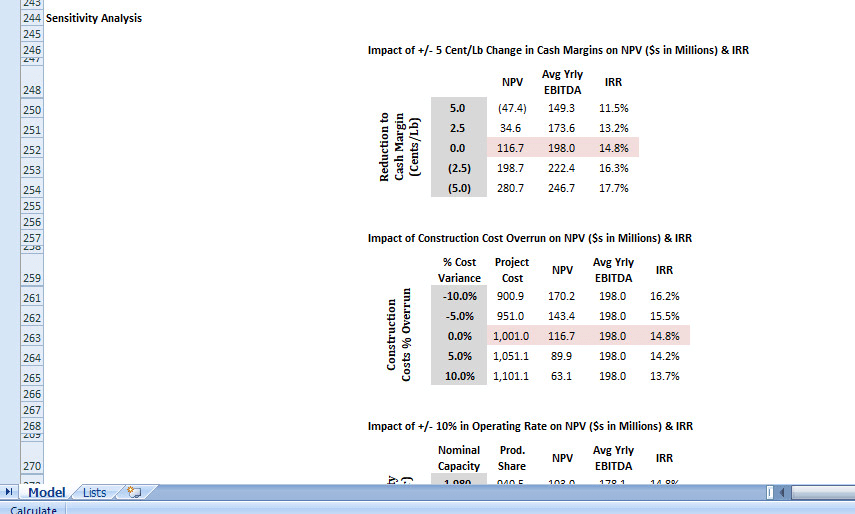

Sensitivity analysis is the study of how the outcome of a decision changes due to variations in input We use it in situations that rely on one or more input variables In contrast, Scenario analysis is the process of predicting the future value of an investment It depends on changes that may occur to existing variablesTwo excellent tools in Excel to conveniently perform scenario analysis are Option Buttons and the WhatIf Scenario Manager Scenario analysis in Excel involves switching different sets of input values into the same set of formulas to compare the differences in outcome The classic example is the Best CaseExpected CaseWorst Case set of scenarios1way data table and a 2way data table The 1way data table is used for when we want to see how sensitive an output is (or many outputs are) when set against the changes of 1 of its inputs (variables)

How To Build Drop Down Scenarios In Your Financial Model Dummies

Sensitivity Analysis Excel Financial Modelling Boti

Risk Analysis Excel templates, addins and spreadsheet solutions for performing risk and sensitivity analysis These Excel solutions allow the performance of probability simulations, volatility assessment and 'what if' scenarios of analysis to assess the sensitivity of alternative outcomes for business case and financial investment proposalsScenario and sensitivity analysis is an important part of financial modelling Although we would like to predict the future exactly unfortunately we cannot Handson guide to scenario analysis Excel reads cell G10 (the first cell in the top row of the data table) It puts G10's value 1 into the driven cell D11 D11 is the chosenThis example is included in this Excel fileEssentially, the assumptions used in the model are linked from cells L17L24 (mainly in cyan) These values are drawn from the scenario table to the right of the highlighted yellow range (eg, cells N17N24 constitute Scenario 1, aka the "Base" case Cells O17O24 constitute Scenario 2) The Scenario Selector is located in cell H12

General Trading W Scenario Analysis Model Efinancialmodels

3

Cost Calculation, Excel, Forecast, Forecasting, Free Financial Model Templates, Revenue Projections, Scenario Analysis, Tutorial This excel file will allow to play with 3 scenarios worst case, base case, and best case and see the results of the scenarios in dynamic graphs Scenario analysis is a process of analyzing possible future events by considering alternativeScenario analysis is a tool to enhance critical strategic thinking A key feature of scenarios is that they should challenge conventional wisdom about the future In a world of uncertainty, scenarios are intended to explore alternatives that may significantly alter the basis for "businessasusual" assumptions

Best Practices For Scenario Analysis Financial Modeling Solver

Hotel Financial Excel Model And Valuation Template Big 4 Wall Street

Best Excel Tutorial How To Create Financial Scenarios

How To Do Sensitivity Analysis With Data Table In Excel

Sensitivity Analysis Excel Example Wall Street Prep

Dynamic Financial Scenario Analysis Using Excel Pakaccountants Com

Generic Monthly 5 Year 3 Statement Rolling Financial Projection Model With Scenario Analysis Eloquens

Financial Modeling In Excel For Dummies For Dummies Lifestyle Fairhurst Danielle Stein Amazon Com Books

Scenario Analysis Of Financial Models Magnimetrics

Sensitivity Analysis Examples Of Sensitivity Analysis

Sensitivity Analysis Microsoft Excel Youtube

Financial Modelling Sensitivity And Scenario Analysis Youtube

Excel What If Analysis How To Use The Scenario Manager

Overview Of Sensitivity Analysis What Is Sensitivity Analysis

Sensitivity Analysis In Excel The Best Template In 21

Sensitivity Analysis In Financial Modeling By Dobromir Dikov Fcca Magnimetrics Medium

Dynamic Financial Scenario Analysis Using Excel Pakaccountants Com

Scenario Analysis 3 Statement Projection Excel Model Eloquens

Build Complex Financial Models With Scenarios And Sensitivity Analysis By Rstansbu Fiverr

Co Working Business Excel Financial Model Oak Business Consultant

Financial Modeling Tips List Of Top 10 Excel Modeling Tips

Using A Data Table To Carry Out Sensitivity Analysis Ms Excel Tutorials

Dynamic Scenario Analysis For Excel Youtube

Scenario Analysis Guide For Finance Professionals By Datarails

Scenario Analysis Modeling In Finance Wall Street Prep

Pristine Financial Modeling Brochure Financial Modeling Microsoft Excel

Scenario Analysis Guide For Finance Professionals By Datarails

Scenario Analysis Of Financial Models Magnimetrics

Building Scenarios In Your Financial Model Dummies

What If Analysis In Excel A Beginner S Guide Step By Step

Sensitivity Analysis Excel Tutorial Video And Template

A Great Function For Scenario Analysis In Excel

How To Create Financial Scenarios In Excel Youtube

What If Analysis In Excel Easy Excel Tutorial

What If Analysis In Excel How To Use Scenario In Excel With Examples

Sensitivity Analysis Learn Advanced Excel Analysis Cfi

Turn What If To What Now The Importance Of Scenario Analysis

Integrated Financial Modeling Ms Excel And Vba For Ms Excel

Scenario Analysis Excel Template Eloquens

How To Build Drop Down Scenarios In Your Financial Model Dummies

Scenario Analysis Of Financial Models Magnimetrics

Excel Finance Class Scenario Analysis For Cash Flow Npv Calculations Youtube

August 17 Webinar What If Analysis Goal Seek Scenario Manager Data Table And Solver In Excel By Michael Olafusi Follow The Nigerian Story Medium

1

How Using A Startup Financial Model Template In Excel Can Solve Your Problems By Efinancialmodel Issuu

Sensitivity Analysis In Excel One Two Variable Data Table

3 1 Perform A Scenario Analysis On The Data Provided Chegg Com

What If Analysis In Excel A Beginner S Guide Step By Step

Sensitivity Analysis An Indispensable Part Of Financial Modelling

Best Practices For Scenario Analysis Financial Modeling Solver

Sensitivity Analysis Learn Advanced Excel Analysis Cfi

Sensitivity Analysis An Indispensable Part Of Financial Modelling

1

Switch Between Various Sets Of Values By Using Scenarios Excel

Switch Between Various Sets Of Values By Using Scenarios Excel

Building Scenarios In Your Financial Model Dummies

Business Model Analysis Excel Dashboard Financial Ratio Financial Analysis Financial Statement Analysis

Scenarios And Sensitivity Analysis Online Financial Modeling Training Kubicle

5 Year Monthy Rolling Financial Model Efinancialmodels

Scenario Analysis How To Build Scenarios In Financial Modeling

Different Scenarios With Excel Self Referencing If Statements Amt Training

Scenario Analysis Modeling In Finance Wall Street Prep

Sensitivities Scenarios What If Analysis What S The Difference Fp A Trends

Microsoft Excel How To Use Scenario Manager Journal Of Accountancy

Sensitivity Analysis In Excel The Best Template In 21

Overview Of Sensitivity Analysis What Is Sensitivity Analysis

Building Scenario Analysis For Financial Models Keyskillset

Scenario Manager In Excel How To Use Scenario In Excel

Excel What If Analysis How To Use The Scenario Manager

Sensitivity Analysis Excel Tutorial Video And Template

Excel What If Analysis How To Use The Scenario Manager

Different Scenarios With Excel Self Referencing If Statements Amt Training

Sensitivity Analysis Excel Example Wall Street Prep

Microsoft Excel How To Use Scenario Manager Journal Of Accountancy

Different Scenarios With Excel Self Referencing If Statements Amt Training

Sensitivity Analysis Examples Of Sensitivity Analysis

Building Scenario Analysis For Financial Models Keyskillset

Break Even Target Profit Analysis With Excel Goal Seek How To Pakaccountants Com

Financial Model Free Excel Template To Fight Covid 19 Eloquens

Scenario Analysis Template In Excel Efinancialmodels

1

Dynamic Financial Scenario Analysis Using Excel Pakaccountants Com In 21 Excel Tutorials Excel Shortcuts Excel For Beginners

Build A Scenario Based Financial Model And Roi Analysis By Vicdlar Fiverr

Using Data Tables In Excel For Real Estate Sensitivity Analysis A Cre

Tutorial 10 Performing Whatif Analyses Microsoft Excel 13

How To Do Sensitivity Analysis With Data Table In Excel

Sensitivity Analysis In Excel One Two Variable Data Table

Overview Of Sensitivity Analysis What Is Sensitivity Analysis

0 件のコメント:

コメントを投稿